First, meet the person to determine if they are a good fit for you. Meeting with a financial adviser will give you the opportunity to learn more about their career, experience, and fees. These are 8 questions that you should ask a financial adviser during the initial meeting. These questions will help you determine if the individual is right for you. An experienced financial advisor can provide advice about how to plan your financial future.

8 questions to ask a financial adviser at your first meeting

Make sure you are clear about what to expect from your first meeting with a financial planner. Ask questions to clarify and decide which criteria are most important to your needs. This will allow you to create a list of questions for your financial advisor. Make sure you do a quick evaluation of the advisor's suitability for you before meeting with them. For example, check to see if the financial advisor is registered with the state and does not have conflicts of interest.

The financial advisor must understand how you spend your money. This will enable them to provide advice on how to help you achieve your goals and manage finances. Some people are strict savers while others spend extravagantly. Ask your advisor for details about your household budget. You should be able ask your advisor about why your household budget has changed and how to adjust it accordingly. Finally, get to know the advisor's personality and style.

Career experience

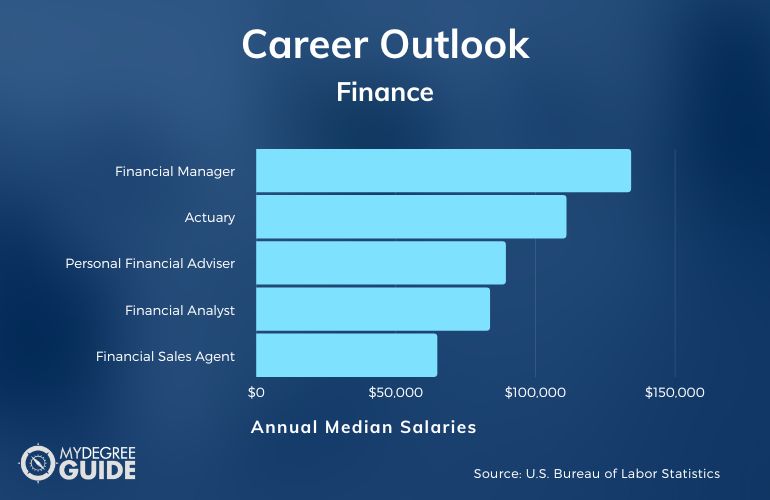

A financial advisor must have solid communication skills and understand the goals of their clients. They must also be proficient in spreadsheet software and have strong analytical and computer skills. A degree in law, business, or finance is the best way to prepare for a job as a financial adviser. Financial firms may require new graduates to have a certain GPA in order to be hired. Once hired, a financial advisor must complete continuing education courses annually.

A bachelor's degree in financial services is required to be a financial advisor. Many professionals start their careers in the investment industry as employees of investment firms. An internship can lead to certifications or advanced degrees. However, you could also enter the field by taking another route. Financial advisors may conduct research on investments and update client's financial plans during internships. They can either start their own business or join a company that has an existing one.

Fees

It's crucial to understand the financial advisor's cost. They may charge thousands of dollars and not disclose other income sources, such as percentage payouts or commissions. They may also be tempted to sell you products that are not in your best interests. If this happens, you must insist on transparent fees from the very beginning. The following questions will help to decide if the advisor’s fee structure is appropriate.

The fees that you pay will impact the amount of advice you receive. Some advisors charge lower fees or charges than others. It's important that you understand the costs of your advisor before signing up for their services. After all, you're paying them to help you create a financial plan, and you don't want to end up with a bad investment outcome!

FAQ

How do I become successful as a consultant?

Finding a passion area is the first step. You must then build relationships. It is important to understand the needs of clients and their business. Finally, you have to deliver results for your clients.

While you don’t necessarily have to excel at every task, you should be better than all the rest. It is important to be passionate about what you do. It isn't enough just to say, "I'm going to be a consultant." It is important to believe in yourself and the work you do.

How can I select a consultant?

There are three key factors to be aware of:

-

Experience - How skilled is the consultant? Is she a beginner? Intermediate? Advanced? Expert? Is her resume a proof of her skills and knowledge?

-

Education - What did this person learn during school? Did he/she take any relevant courses after graduating? Do we see any evidence of this learning in the way he/she writes?

-

Personality: Do you like this person or not? Would we hire him/her to be our employee?

-

These questions will help us determine if the consultant is right to meet our needs. If you do not have the answer, it is worth interviewing the candidate to find out more.

Why should consultants be hired?

You might need consultants for a variety of reasons.

-

Your organization may have a specific project or problem that needs solving

-

You want to improve your own skills or learn something new

-

You would like to work with an expert in your field.

-

No one else is available to take on the task.

-

You feel overwhelmed with all the information you see and don’t know where it is.

-

You don't have the money to pay someone full time

The best way to find a good consultant is through word of mouth. Ask your network if they are aware of any credible consultants. Ask someone you already know to recommend a consultant.

You can use online directories such as LinkedIn to find consultants in your local area.

What is the difference between consulting and freelancing?

Freelancers are self-employed individuals who offer their services to clients without employees of a company or agency. They charge hourly rates depending on the amount of time spent on a client's projects. Consultants work for companies and agencies that employ them. Their salaries are usually paid monthly or annually.

Freelancers tend to have more flexibility than consultants because they control their work hours and set their own prices. Consultants, however, often have better benefits such as retirement plans, vacation days, and health insurance.

Statistics

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

External Links

How To

What is a typical day for a consultant?

Your work type will determine the length of your day. You will be spending time researching, planning new ideas, meeting with clients, and creating reports.

Clients will often meet with you to discuss their problems. These meetings can be held over the telephone, online or face-to face.

You may also be asked to prepare proposals, which are documents outlining your ideas and plans for clients. These proposals should be discussed with a mentor or colleague before being presented to clients.

After all the preparation and planning, it's time to actually create some content. You might be creating articles, videos, editing photos, writing interviews, or designing websites.

Depending on your project's scope, it may be necessary to do research to get relevant statistics. You might need to determine how many customers you have, and whether they buy more than one product.

After gathering enough information, you can present your findings to clients. You may give your findings orally or in written form.

Finally, you must follow up with clients after the initial consultation. You can call clients to ask how they are doing or send emails asking for confirmation that your proposal was received.

While this can be a slow process, it's essential to remain focused and maintain good working relationships with clients.